Selling into capital markets isn’t like selling into any other industry. Hedge funds and asset managers are complex organizations where a single deal might involve multiple stakeholders across investment, operations, and compliance teams.

If you’re trying to win business in this space, understanding buy-side org charts isn’t optional—it’s your competitive edge.

In this guide, we’ll walk through:

- How buy-side firms are structured

- Who really makes buying decisions

- The common pain points you must address

- How tools like HedgeID help map the path to your next deal

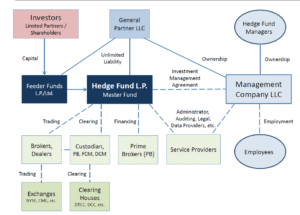

1. Anatomy of a Buy-Side Org Chart

No two buy-side firms look exactly alike—but most share a similar framework of roles and reporting lines.

Here’s a quick breakdown of key positions you’ll encounter:

- Portfolio Manager (PM)

Manages specific investment strategies and makes day-to-day trading decisions. - Chief Investment Officer (CIO)

Oversees the firm’s overall investment philosophy and risk management. - Chief Operating Officer (COO)

Handles the operational side of the business, including technology, vendors, and process efficiency. - Compliance Officer

Ensures the firm stays aligned with regulations and industry standards. - Analyst

Supports PMs and CIOs with research, modeling, and idea generation.

Did you know?

In smaller hedge funds, the PM and CIO might be the same person, while larger asset managers often separate these roles for clearer oversight.

Hedge Funds vs. Asset Managers

While both sit on the “buy-side,” hedge funds and asset managers often differ in:

- Decision-making style: Hedge funds can be nimble; asset managers often follow formal committees.

- Org chart layers: Asset managers tend to have more layers and specialists (e.g., ESG officers, dedicated risk teams).

- Vendor onboarding: Asset managers often have longer, more structured procurement cycles.

For definitions of key roles and terms mentioned here, see our Glossary.

2. Who Makes Buying Decisions?

One of the biggest mistakes vendors make is assuming the PM is always the buyer. The truth is… decisions on new vendors are rarely made in isolation.

Primary Decision Makers vs. Influencers

- Decision Makers:

- CIO

- COO

- Senior PMs

- Head of Compliance (for anything touching data, privacy, or processes)

- Influencers:

- Analysts who research vendor solutions

- Operations staff who evaluate integrations

- Middle-office teams concerned with reporting or data flow

Even for small deals, compliance or operational signoff is often required.

Pro Tip:

Always ask, “Who else would be involved in evaluating this kind of decision?” It signals professionalism—and saves time.

3. Tactics for Mapping and Reaching Decision Makers

Understanding org charts is only the start. You also need to map relationships and identify influence.

Building a Relationship Map

Beyond LinkedIn, look at:

- Regulatory filings showing executive changes

- Press releases about fund launches or new mandates

- Industry conference speaker lists

- Historical employment connections

A PM who previously worked with your existing client can be your best warm intro.

LinkedIn: Useful, but Not Enough

LinkedIn is great for names and titles—but:

- It doesn’t show who reports to whom in most hedge funds.

- Profiles may lag behind real-world changes.

- It misses the nuanced relationships critical in capital markets.

How HedgeID Helps

HedgeID takes relationship mapping to the next level:

- Visual org charts showing reporting lines

- Historical connections between professionals

- Alerts on personnel moves so you know when your contacts change firms

4. What Matters to the Buyer?

Even the best org chart won’t help you if your message misses the mark. Here’s what keeps buy-side decision makers awake at night:

Common Pain Points:

- Regulatory risk: Staying compliant with rules like MiFID II, SEC, and GDPR.

- Operational efficiency: Avoiding manual workarounds and data silos.

- Data reliability: Trusting the accuracy and timeliness of critical data.

- Time-to-alpha: Gaining an investment edge before competitors.

- Cost justification: Proving ROI on any new solution.

Tip for Sales Teams:

A generic pitch about “great technology” won’t resonate. Show how your solution solves specific problems, such as regulatory reporting headaches or faster decision-making.

5. Accelerating Sales with Better Intelligence

A single piece of intelligence can completely change your sales outcome.

Example:

A vendor was targeting a large hedge fund but kept getting stalled with junior analysts. By discovering the COO’s name and direct reports through org chart mapping, they reached the right stakeholder and closed the deal three months faster.

That’s the power of combining:

- Org charts

- Market signals (fund launches, AUM changes)

- Relationship data

HedgeID’s Advantage:

HedgeID surfaces these connections automatically, helping sales teams focus their energy on the right people at the right moment.

Conclusion

Understanding buy-side org charts is your secret weapon in capital markets sales. The firms who win are those who:

- Know who the real decision makers are

- Map influence and relationships

- Tailor messaging to genuine buyer pain points

In a space where one missed connection can cost millions in potential revenue, the right intelligence makes all the difference.

Bottom line:

Stop guessing who to call. Start mapping your prospects like a pro.

Ready to map your next buy-side deal with confidence?

See how HedgeID helps capital markets teams target the right stakeholders and move faster.