Identify the right firms, strategies, and decision-makers with greater precision.

414,000 Market Participants

1 M+ Daily Signals Processed

141,000 Financial Entities

1000+ Daily Contibutors

414,000 Market Participants

1 M+ Daily Signals Processed

141,000 Financial Entities

1000+ Daily Contibutors

414,000 Market Participants

1 M+ Daily Signals Processed

141,000 Financial Entities

1000+ Daily Contibutors

414,000 Market Participants

1 M+ Daily Signals Processed

141,000 Financial Entities

1000+ Daily Contibutors

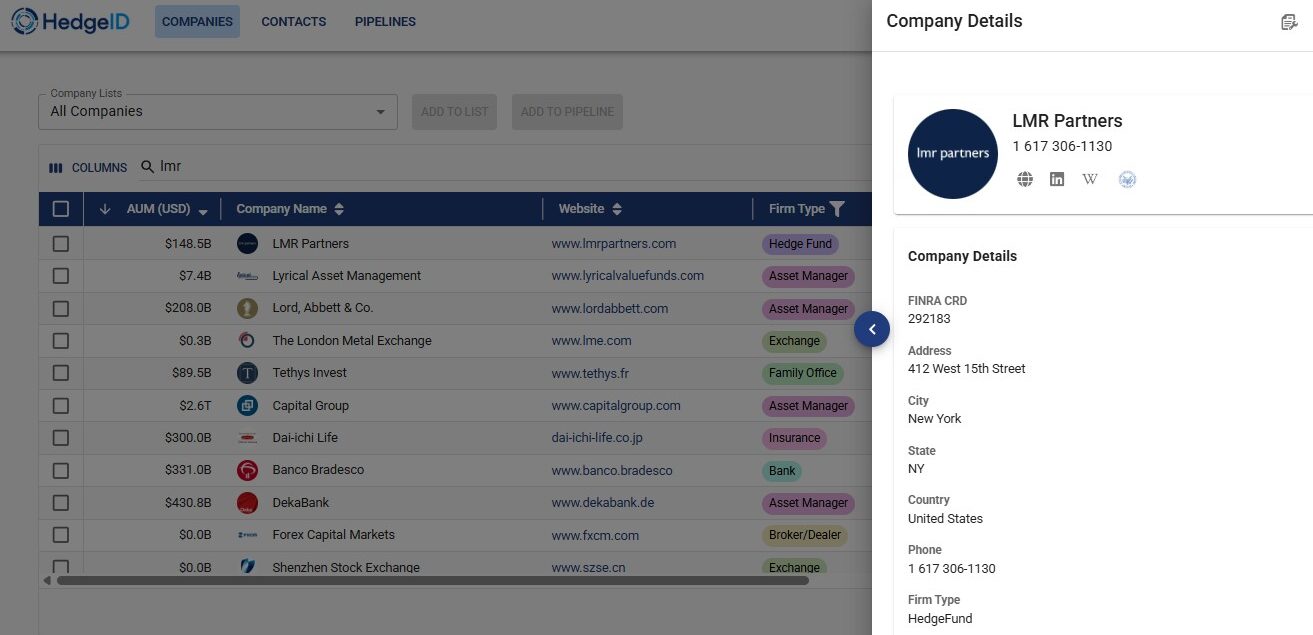

HedgeID organizes capital markets firms, strategies, and decision-makers into a single, consistent data model. Teams filter and segment accounts by strategy, asset class, and organizational context to identify relevant buyers, understand buying dynamics, and keep systems accurate as organizations change.

Identify the capital markets firms most likely to buy and the decision-makers who influence outcomes. HedgeID models firm strategy, structure, and roles so teams can focus on the right accounts earlier and identify similar firms that match their ideal customer profile.

Capital markets data changes constantly. HedgeID maintains firm and contact records as organizations evolve, reducing data decay, rework, and misrouted outreach.

Sales, Marketing, and RevOps teams work from a shared, reliable view of accounts and contacts. This reduces manual cleanup and enables faster, more coordinated execution across the funnel.

We leverage a dynamic community of capital markets aspirants and professionals, alongside validated data partners, to source ground-truth intelligence.

Automated checks and human-in-the-loop validation processes create a constantly learning and self-correcting data ecosystem.

AI algorithms identify patterns, verify connections, and enrich records, ensuring our data is not just accurate, but deeply contextualized.

We simplify market complexity by mapping firms, contacts, and relationships into a clear, actionable view—helping you connect with the right people, faster.

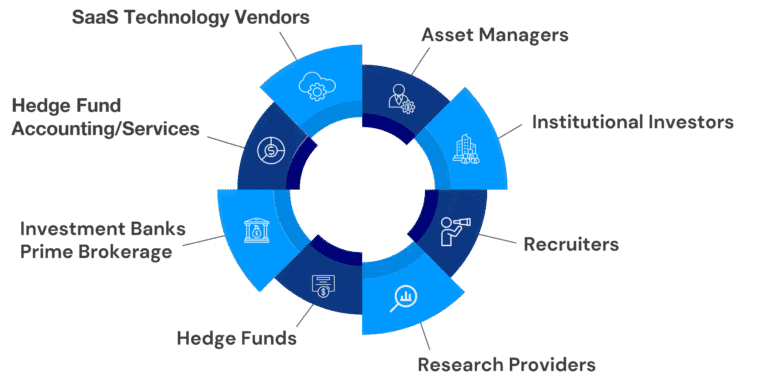

The HedgeID commercial intelligence platform encompasses investment managers, asset owners, and risk-takers across all major asset classes, creating a global, cross-asset view of the institutional finance landscape.

HedgeID ensures superior data quality by embedding rigorous validation and reliability practices throughout the entire data lifecycle—from sourcing to your screen—guaranteeing intelligence you can trust.

Access our data your way. Choose a tailored subscription and receive information via diverse formats (JSON, CSV, etc.) or integrate seamlessly to your system of record with our robust API.

HedgeID is powered by a multidisciplinary team of developers, advisors, and seasoned finance professionals.

We have a shared mission: to simplify the complexities of capital markets through collaboration, innovation, and a deep respect for accuracy, design, and impact.

By combining trusted intelligence with a user-first experience, we support long-term success across investment, business development, and research teams – earning the confidence of professionals who rely on HedgeID every day.

CRO, Global Macro Fintech

Head of BD, Capital Markets SaaS