Why this matters:

Hedge funds control trillions in assets and are among the most sophisticated buyers in financial services. The sales process has evolved—today’s winning sales teams blend data-driven targeting, relationship mapping, and perfect timing. Here’s how to break in, build trust, and win deals with hedge funds in 2025.

Understanding the Hedge Fund Buyer

Selling to hedge funds is different from selling to corporates or traditional asset managers. Every fund is unique—strategies, team structures, and decision-making styles can vary widely. The common thread? Each is hyper-focused on performance, security, and efficiency.

Types of Hedge Funds:

- Quantitative (Quant) Fund: Uses mathematical models, algorithms, and large datasets to drive investment decisions.

- Global Macro Fund: Invests based on macroeconomic trends and forecasts across global markets.

- Equity Long/Short Fund: Buys stocks expected to rise (“long”) and sells short those expected to fall (“short”), seeking to profit in both directions.

- Event-Driven Fund: Invests around events like mergers, acquisitions, restructurings, or bankruptcies.

- Multi-Strategy Fund: Employs multiple investment strategies within one fund to diversify and manage risk.

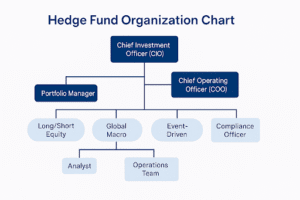

Key Decision Makers:

- Portfolio Manager (PM): Responsible for investment strategy and daily trading decisions.

- Chief Investment Officer (CIO): Oversees investment philosophy, risk, and portfolio construction.

- Chief Operating Officer (COO): Manages operations, technology, and vendor relationships.

- Compliance Officer: Ensures regulatory standards and oversees new vendor onboarding.

- Analyst: Supports PMs and CIOs with research, modeling, and due diligence.

For additional term review our simple Glossary.

Buying Process: What to Expect

While every fund is unique, many share these common steps when evaluating vendors:

- Multi-Stakeholder Review: Decisions often involve investment, operations, and compliance teams.

- Due Diligence: For sensitive or high-value solutions, funds frequently require due diligence questionnaires (DDQs) or security reviews.

- RFPs: Some funds issue Requests for Proposal for technology, data, or significant service buys, especially at larger or institutional firms.

- Personal Relationships: For smaller purchases or niche solutions, decisions may be made quickly and based on the relationship and fit.

Research and List Building

The days of buying a hedge fund list and blasting cold emails are over. Hedge funds expect outreach that’s informed and relevant.

Where to Find Data:

- Regulatory filings (SEC, FCA, etc.) and industry directories

- Trade publications, news, and press releases

- Specialized platforms with live, enriched profiles

Why CRM Alone Isn’t Enough:

Traditional CRMs rarely keep up with buy-side personnel moves, fund launches, or team restructuring. Manual list-building leads to wasted effort, bounced emails, and missed deals.

Pro Tip:

Modern sales teams rely on live data enrichment and relationship mapping—not just name and email.

See: Why CRM Data Alone Isn’t Enough for Capital Markets Sales Teams

Effective Outreach Strategies

Once you’ve built your list, it’s about quality, not quantity. Hedge fund decision makers are bombarded with generic pitches—yours needs to stand out.

Customizing Messages by Role

- PMs: Focus on performance, alpha generation, or differentiated insights.

- COOs: Highlight workflow improvements, security, and operational efficiency.

- Compliance Officers: Emphasize data integrity and regulatory compliance.

Leverage Org Chart & Relationship Mapping

- Find the right entry point using org charts and relationship data.

- Reference shared connections or recent firm changes to demonstrate you’ve done your homework.

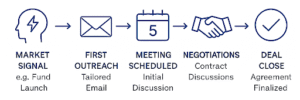

Time Your Outreach with Market Signals

- New fund launches

- Recent executive moves

- Changes in AUM or investment strategy

Timing is everything:

Reaching out right after a fund launch or executive move can double your response rate.

Sample Outreach Email Template (with Pointers)

When reaching out to a hedge fund contact for the first time, keep it concise, relevant, and personalized. Use this template as a guide:

Subject Line:

Reference a recent event (“Congrats on your new role at [Firm]”), a market event, or a shared connection.

Greeting:

Hi [First Name],

Opening Context (Why you’re reaching out):

Briefly explain how you found them or what prompted your email.

E.g., “I saw your recent move to [Firm] and work with vendors who help funds like yours [achieve a specific goal].”

Value Proposition (What’s in it for them):

State a relevant benefit based on their role/firm type.

E.g., “Many PMs in your space are streamlining [challenge] as they grow.”

Call to Action (What you want next):

Suggest a brief call or reply.

E.g., “Would you be open to a 20-minute call next week to see if there’s a fit?”

Close:

Thanks,

[Your Name]

[Your LinkedIn or company info]

Why each section matters:

- Subject line: Gets attention with relevance/personalization

- Context: Explains why your outreach isn’t random

- Value prop: Shows you understand their needs

- Call to action: Sets a low barrier to engagement

Nurturing and Winning the Deal

The sale rarely ends with the first meeting. Hedge funds have multi-step procurement and compliance processes.

Handling Due Diligence & Compliance Reviews

- Expect requests for security, KYC/AML, and operational due diligence.

- Provide transparent documentation and references.

Navigating Procurement and RFPs

- Respond promptly and thoroughly to RFPs and DDQs.

- Build relationships across investment, ops, and compliance teams.

Ongoing Engagement

- Continue tracking personnel moves and fund changes after the deal.

- Offer support as the fund evolves—renewal and upsell opportunities often arise from new launches, strategies, or leadership.

Conclusion

Bottom line:

Modern hedge fund sales are won by teams who leverage better data, time their outreach perfectly, and understand the evolving structure of every fund.

The sales landscape is more competitive than ever, but those who master the playbook will consistently win.

Ready to put this playbook into action? Book a demo and see how HedgeID helps you sell smarter into hedge funds.