In capital markets, people drive deals—and those people move constantly.

Portfolio managers spin out to start new funds. Analysts step into decision-making roles. COOs jump firms and bring trusted vendors with them.

If you’re not tracking personnel movement, you’re not just missing intel. You’re missing windows of opportunity.

Why Tracking Moves Matters More Than Ever

Hedge funds and asset managers don’t just change slowly through strategy shifts. They evolve in real time through who’s sitting in the seat.

One new hire can reshape vendor relationships, budgets, and business priorities overnight.

Did you know?

Nearly 25% of senior hedge fund roles turn over within 18 months, according to internal HedgeID data.

That’s not churn. That’s your next buying signal.

1. The Reality: Hedge Fund Turnover Is Constant

People don’t stay put for long in this world—and that’s not a problem. It’s your opening.

Here’s what movement often signals:

-

PMs launching new funds → fund formation in progress

-

COOs moving firms → back-office overhaul likely

-

Analysts becoming PMs → new vendor decisions incoming

Each shift is a chance to reframe your pitch—or restart a relationship.

📖 See Glossary: Fund Launch, Market Signals, Org Chart Mapping

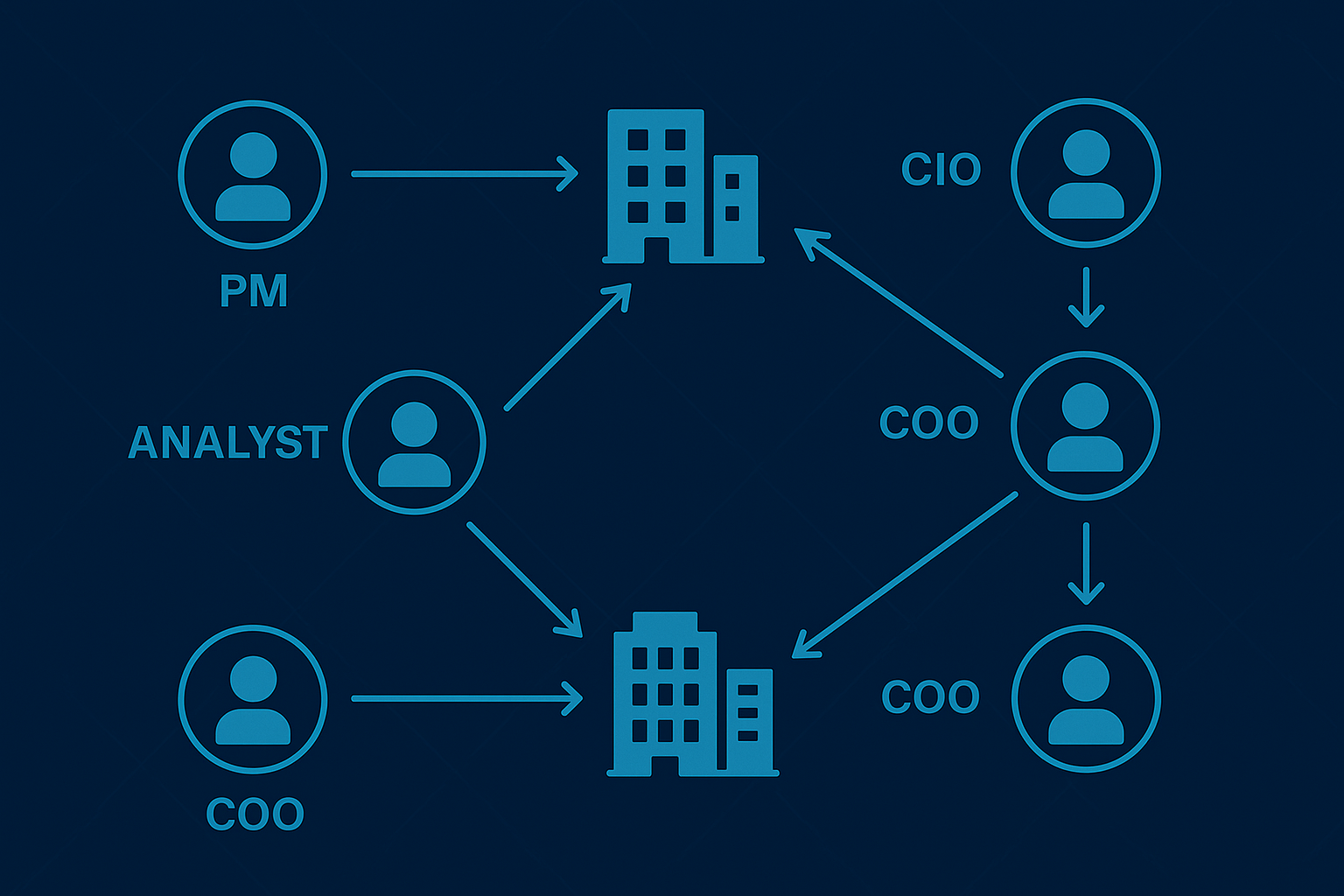

Visual Suggestion:

A “before and after” org chart showing a CIO seat changing hands—alongside vendor shakeups.

2. Why Personnel Moves Are a Goldmine for Sales Teams

Tracking firms isn’t enough. You need to follow the people—because people carry pain points, preferences, and purchasing power.

New Role = New Needs

Someone stepping into a senior seat often reevaluates inherited vendors.

They may:

-

Replace tools they disliked in their last job

-

Look for solutions they already trust

-

Explore categories their predecessor overlooked

Fresh Leadership = Openness to Change

New hires tend to ask:

“What can we do better?”

That mindset creates a perfect moment to introduce something new.

Warm Intros = Fast Wins

If someone you helped at a previous firm moves into a new role, that’s not just a contact. That’s a shortcut to trust.

Pro Tip:

If a contact moves firms and you helped them succeed before—reach out right away. Many buyers re-buy from vendors they trust.

🧠 Related: How to Sell Into Hedge Funds →

3. What to Track (And Why It’s Hard Without Help)

Tracking the right people means knowing more than just names.

You need to watch:

-

PM, CIO, COO changes—because these are the roles with budget and authority

-

Internal promotions—an analyst today may be your buyer tomorrow

-

Cross-firm moves—your biggest champions often don’t stay at one shop

The Challenge:

-

LinkedIn lags. It’s often weeks behind real movement.

-

Filings are hard to parse. ADV changes don’t come with context.

-

Your CRM gets stale. Contacts age fast without constant updates.

Reminder:

People don’t announce every move. You need tools that detect them.

4. How to Act on Personnel Movement Signals

Knowing someone moved is just the start. Here’s how top sales teams turn signals into sales:

🔁 Former User Joins a New Firm?

Send a short note:

“Saw you joined Alpha Fund—congrats! If you’re rebuilding a stack, let me know how we can help.”

📈 Analyst Promoted to PM?

Now’s the time to introduce your solution.

They’re likely building a workflow and evaluating tools.

🧭 New PM or COO Appointed?

Get in quickly—before they set their tech stack in stone.

With HedgeID:

We track personnel changes in real time—across hedge funds, asset managers, and institutional allocators.

You’ll get:

-

Alerts on who moved where

-

Their previous firm and reporting line context

-

Signal strength based on role seniority and firm size

Visual Suggestion:

A sample alert:

“Jane Doe appointed Portfolio Manager at Alpha Fund (previously at Omega Capital). Reports to CIO John Smith.”

💡 Related: Signs That a Fund is Launching →

Conclusion: Follow the People, Follow the Opportunity

Too many vendors focus on firm-level changes—and miss the real story.

In capital markets, relationships drive revenue. That means:

-

Know where your champions land

-

Act when new decision-makers arrive

-

Engage when priorities shift

If you’re still waiting for your CRM to “catch up,” you’re already behind.

With HedgeID, you don’t just track firms. You track the people who drive decisions.

Ready to surface personnel signals before your competitors do?

Related Reading

📘 CRM vs Intelligence Platform: What Your Capital Markets Team Actually Needs →

📘 Signs That a Fund is Launching — and How to Win the Business →

📘 How to Sell Into Hedge Funds: A Modern Playbook →