HedgeID Articles

When most capital markets vendors plan their outreach, they aim high—CIOs, COOs, Portfolio Managers. But here’s what they miss: Big decisions often start small. Analysts, operations leads, and other mid-level staff are the ones researching vendors, writing internal memos, and...

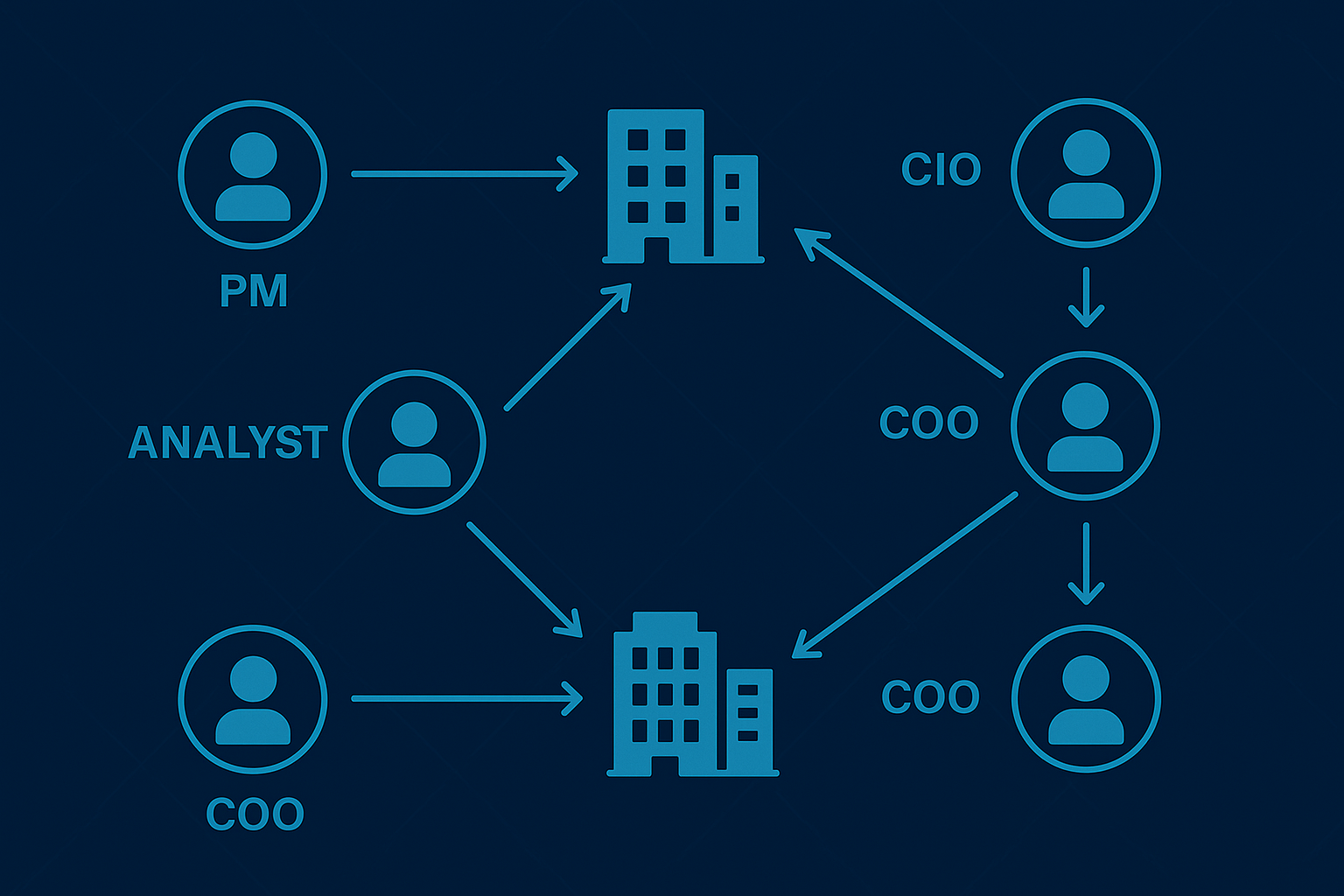

In capital markets, who you target matters just as much as how you reach them. Spray-and-pray doesn’t work here. Hedge funds and asset managers don’t have time for cold, generic outreach—and neither should you. To consistently land quality conversations, you...

In capital markets, people drive deals—and those people move constantly. Portfolio managers spin out to start new funds. Analysts step into decision-making roles. COOs jump firms and bring trusted vendors with them. If you’re not tracking personnel movement, you’re not...

Selling into a fund before it’s officially “live” is one of the most overlooked sales advantages in capital markets. Why? Because launch-stage funds need to make fast, foundational decisions—on data providers, compliance tools, analytics platforms, and more. If you catch...

Selling into capital markets isn’t like selling into any other industry. Hedge funds and asset managers are complex organizations where a single deal might involve multiple stakeholders across investment, operations, and compliance teams. If you’re trying to win business in...