Tracking Personnel Movement in Capital Markets: The Hidden Signal That Drives Sales

In capital markets, people drive deals—and those people move constantly.

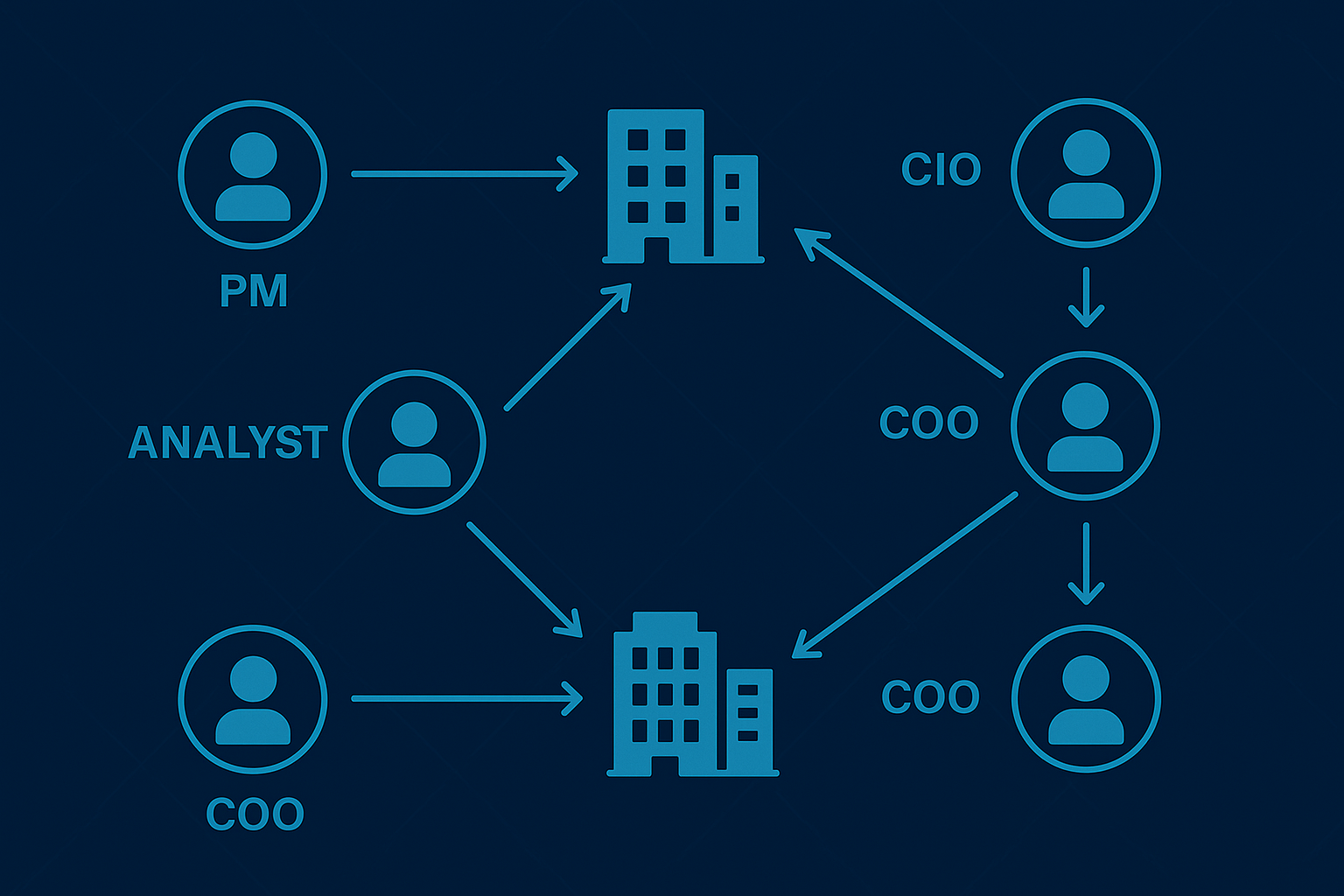

Portfolio managers spin out to launch new funds. Analysts get promoted to decision-making roles. COOs jump firms and bring preferred vendors with them.

If you’re not tracking these movements, you’re missing critical buying signals and windows of opportunity.

Why Tracking Personnel Movement Matters

Most vendors monitor firm-level data. But in hedge funds and asset managers, real change happens when people move.

-

A new PM can overhaul a tech stack

-

A new COO can shift operational strategy

-

A former analyst turned PM may now have vendor authority

📊 Internal HedgeID data shows that nearly 25% of senior hedge fund roles turn over within 18 months.

That’s not churn. That’s your next opportunity.

1. The Reality: Hedge Fund Turnover Is Constant

Personnel shifts happen faster than public data can capture—and each one can create a new path to revenue.

| Movement | Buying Signal |

|---|---|

| PM spinout | Fund formation likely in progress |

| COO switch | Back-office or vendor stack overhaul ahead |

| Analyst promoted to PM | New decision-maker, open to evaluating solutions |

📖 See glossary: Fund Launch, Market Signals, Org Chart Mapping

🔎 Visual suggestion: “Before and after” org chart showing role change and vendor impact

2. Why People Moves Are a Sales Goldmine

Firms don’t make decisions—people do. And new people bring new preferences, budgets, and strategies.

A New Role = New Needs

-

A newly appointed CIO may discard legacy tools

-

A new COO may bring in trusted vendors from their previous firm

-

A new PM may explore product categories previously ignored

Buyers often re-buy from vendors they trust—especially when switching firms.

Fresh Leadership = Openness to Change

New decision-makers often ask:

“What needs improvement?”

This creates a window where your product—if positioned right—can replace existing solutions.

Warm Relationships = Fast Wins

When a former client takes on a new role, it’s not just a lead—it’s a warm, trust-based opportunity.

💬 Pro Tip:

When a contact you’ve worked with changes firms, reach out immediately. Reference the success you delivered before.

🧠 Related Reading: How to Sell Into Hedge Funds: A Modern Playbook

3. What to Track (and Why It’s Hard)

Tracking movement requires more than just LinkedIn. You need to know:

-

Who moved

-

From where

-

To where

-

What role they took on

-

What authority or influence they now have

Key Roles to Monitor:

-

PMs, CIOs, COOs – budget holders and tech decision-makers

-

Analysts and Directors – rising influencers and future buyers

-

Cross-firm alumni – warm entry points via shared history

Why Traditional Tools Fall Short:

| Tool | Limitation |

|---|---|

| Lags updates, lacks reporting structures | |

| CRM | Goes stale without constant updates |

| Regulatory Filings | Hard to parse, lack hiring context |

📌 Reminder: People don’t always announce moves. You need a system that detects and validates them.

4. How to Act on Personnel Movement Signals

Knowing someone moved is just the beginning. Here’s how to turn that insight into revenue.

🎯 Former User Joins a New Firm?

Send a personalized email:

“Saw you joined Alpha Fund—congrats! If you’re rebuilding your stack, we’d love to support you again.”

🧱 Analyst Gets Promoted to PM?

Reach out early—they’re likely open to building their own workflow.

🧠 New CIO or COO Appointment?

Move fast. These roles often define vendor and infrastructure strategy within the first 90 days.

With HedgeID, You Can:

-

Detect personnel changes across hedge funds, asset managers, and allocators

-

See previous firm data and reporting context

-

Get signal strength based on role and firm size

-

Visualize changes across org charts and reporting lines

🔔 Visual suggestion:

“Jane Doe appointed PM at Alpha Fund (formerly Omega Capital). Reports to CIO John Smith. High-influence move.”

💡 Related: Signs That a Fund Is Launching — and How to Win the Business

Conclusion: People Drive Revenue

Most vendors focus on firms. The smartest ones track people—because:

-

Relationships drive influence

-

Role changes signal buying windows

-

Timing is everything

If you’re relying on CRM updates or LinkedIn notifications, you’re too late.

With HedgeID, you get real-time alerts on who moved, when, where, and why it matters.

Book a Demo

Ready to follow the people—not just the firms?

👉 Book a demo to see how HedgeID helps you track key decision-makers and engage at the moment of maximum opportunity.